Financial Pandora (FINPA)

Amortised cost is a valuation method used with financial assets or financial liabilities under IAS 39.

According to IAS 39 the amortised cost of a financial asset or financial liability is the amount at which the financial asset or financial liability is measured at initial recognition minus principal repayments, plus or minus the cumulative amortisation using the effective interest method of any difference between that initial amount and the maturity amount, and minus any reduction for impairment or uncollectibility.

The effective interest rate is the rate that exactly discounts estimated future cash payments or receipts through the expected life of the financial instrument or, when appropriate, a shorter period to the net carrying amount of the financial asset or financial liability. For a floating rate instrument that is carried at amortised cost, the current effective interest rate should be used to discount the estimated cash flows.

At each balance sheet date it is necessary to assess whether there is an objective evidence that any financial asset not measured at fair value through profit or loss is impaired or uncollectible. If there is any objective evidence that such an asset is impaired, the amount of any impairment loss must be calculated.

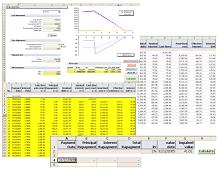

Global Risk Guard has developed Financial Pandora (FINPA). FINPA is an excel spreadsheet developed using VBA which will permit to calculate amortised cost and to perform impairment calculation for loans and bonds.

Several corporations that are reporting under IAS/IFRS have already chosen to use FINPA to calculate amortised cost. FINPA represents a flexible stand-alone software solution to evaluate at amortised cost any kind of financial instrument according to IAS 39 methodology.

The valuations performed by FINPA are also accepted by the major auditing firms.